Money Transfer App

With globalization and an increasingly interconnected world, international money transfers are becoming more common. Whether it’s for sending money to family and friends, paying for goods and services, or conducting business transactions, there are many reasons why you need to transfer money across borders.

Luckily, many international money transfer apps are available to help make this process easier, faster, and cheaper. However, knowing which one to use can be difficult with many options. This article will outline the key factors you should consider when selecting an international money transfer app.

Table of Contents

Fees

One of the significant factors to consider when choosing an international money transfer app is the fees involved. These fees can vary significantly from one app to another, including upfront fees, hidden fees, and foreign exchange markups.

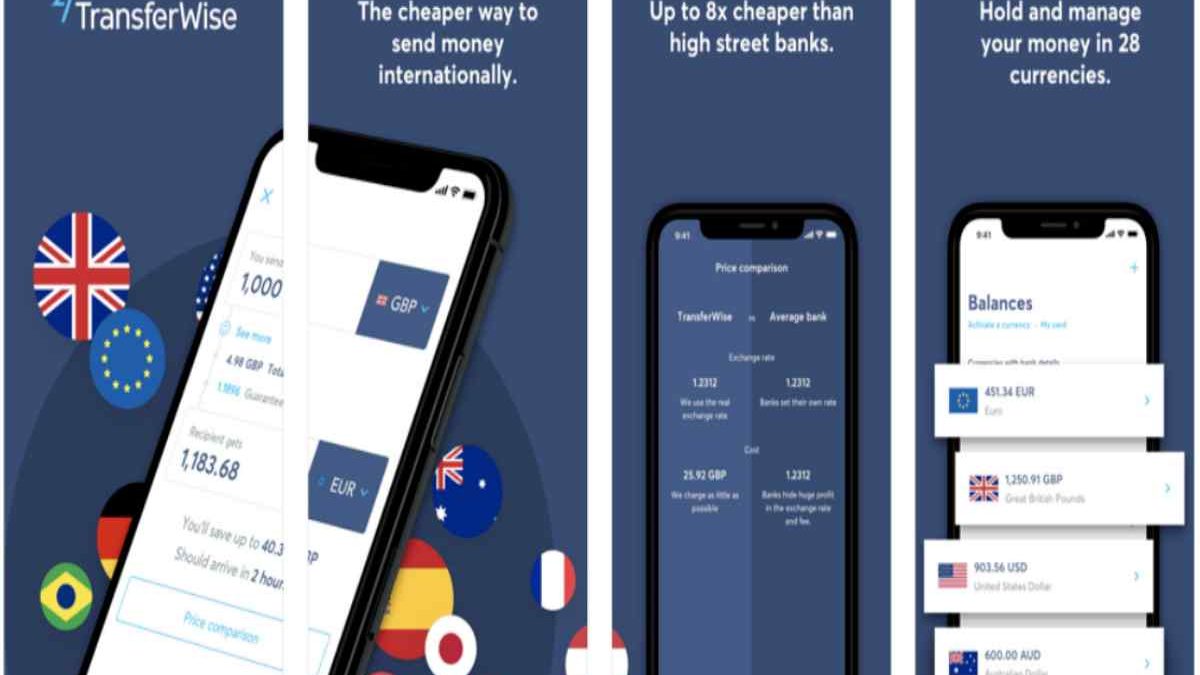

Before choosing an app, ensure you understand the transfer’s total cost, including all charges. Look for an app that is transparent about its fees and offers competitive rates. Some apps, such as TransferWise, charge a flat fee plus a small percentage of the transfer amount, while others may offer fee-free transfers up to a certain amount.

Exchange Rates

Exchange rates are another critical factor when choosing an international money transfer app. Exchange rates can fluctuate throughout the day and can vary from one provider to another.

Look for an app that offers real-time exchange rates and provides competitive rates. Be wary of apps offering rates too good to be true, as they may have hidden fees or other charges that offset any savings you might make on the exchange rate.

Security Features

Security is essential when it comes to international money transfers. Be cautious of apps that ask for sensitive information like your social security number or passport number, as this could put you at risk of identity theft.

Some vital security features include two-factor authentication, biometric login (such as fingerprint or facial recognition), and end-to-end encryption. Additionally, ensure a reputable financial authority regulates the app and that it adheres to industry-standard security protocols.

Customer Support

If you encounter any issues with your international money transfer, it is crucial to have access to reliable customer support. Search for an app that offers multiple customer support channels, such as phone, email, or chat, and make sure that help is available in your preferred language and time zone.

Additionally, read reviews from other users to understand how responsive and helpful the app’s customer support team is.

Speed

When it comes to international money transfer apps, the speed of transfer can vary significantly. Some apps offer near-instant transfers, allowing the recipient to receive the funds within minutes or even seconds. Other apps may take several days to process, especially if it involves multiple currencies or international bank transfers.

If speed is a priority for you, choose an app offering fast and reliable transfer times. Fast transfers may come with higher fees, so weigh the benefits of speed against the cost.

Transfer Limits

Transfer limits refer to the maximum amount of money that can be transferred at once using an international money transfer app. Many apps have limits on the amount that you can transfer due to various factors such as regulatory requirements, security concerns, and operational limitations.

When choosing an international money transfer app, consider transfer limits and ensure the app can accommodate your needs. If you anticipate transferring large amounts of money, look for an app with higher transfer limits to avoid making multiple transfers.

User Experience

User experience (UX) refers to a user’s overall experience when interacting with a product or service, such as an international money transfer app.

An excellent international money transfer app should offer various options for transferring money, including bank transfers, credit card payments, and other methods. This allows users to choose the most convenient and cost-effective option for their needs, helping to ensure a positive overall experience.

In addition, the app should be available in your preferred language, ensuring you can easily understand the instructions and navigate the app. This can eliminate language barriers and make transferring money more comfortable and stress-free.

Summary

Choosing the best international money transfer app is a daunting task, but with careful analysis of certain key factors, you can make an informed decision. Comparing these factors across different apps to better understand which app is the best for your needs.

Additionally, reading reviews and researching the app’s reputation helps you make a more informed decision. By taking the time to consider these factors and doing your due diligence, you can choose the best international money transfer app for your specific needs and budget.

Review How to Choose the Best International Money Transfer App.